ev tax credit bill number

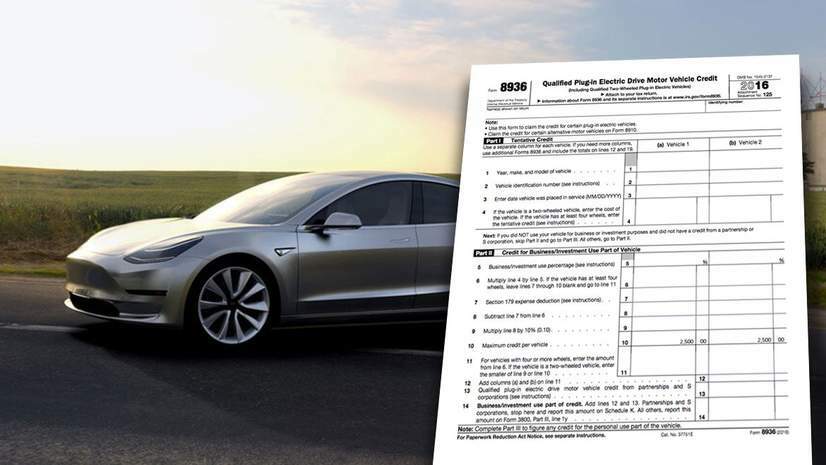

The qualified plug-in electric drive motor vehicle credit phases out for a manufacturers vehicles over the one-year period beginning with the second calendar quarter after the calendar quarter. New battery electric cars that cost more than 55000 do not qualify for the EV tax credit.

New Federal Ev Tax Credit Bill Mercedes Eq All Electric Forum

16 created a tax credit for consumers who buy new electric vehicles.

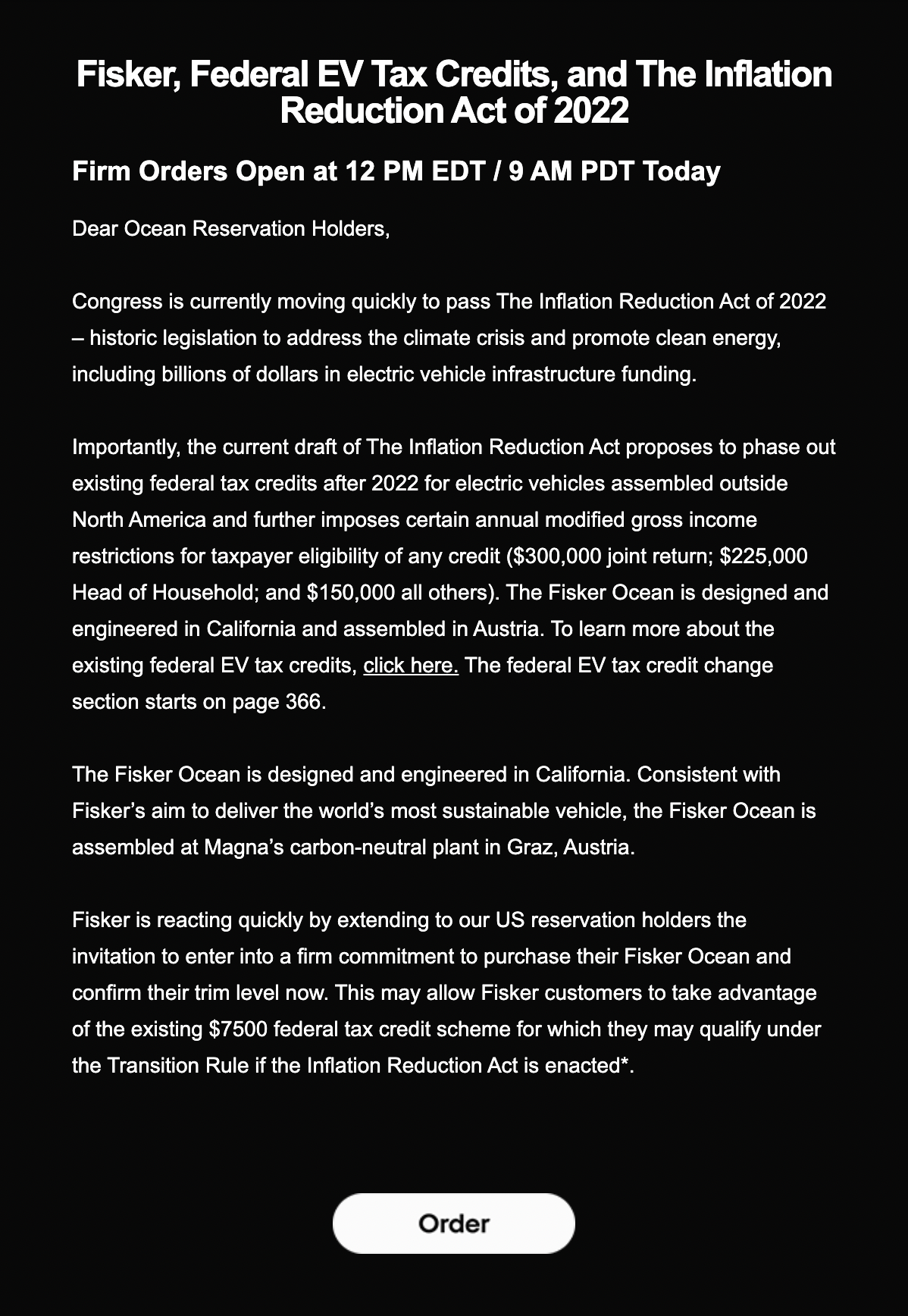

. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. To assist consumers identifying eligible vehicles the Department of Transportation and Department of Energy published new resources today to help those interested in claiming tax. The clean vehicle credit is worth up to 7500.

Remove the limitation on the number of vehicles per. 2023 will also usher in limits on qualifying EV costs. Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV credit for.

An estimate from the Congressional Budget Office forecasts 11000 new EVs will receive tax credits in 2023 assuming 7500 per vehicle. Under the old system the EV tax credit of 7500 was applied to a narrower range of cars. The sweeping legislation contains a slew of incentives aimed at helping individuals who want to make more climate-friendly choices chief among them new tax credits for electric vehicles.

Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs. Georgia Democratic Senator Reverend Warnock has proposed a new bill that may help more automakers initially qualify for the new US federal. Extends tax credit of up to 7500 on qualified new EVs and hybrid vehicles through 2032.

In addition the bill modifies the credit to. It will even be available on used EVs with a credit of up to 4000 on cars priced 25K or less and subject to a number of other requirements including a lower income cap of 75k150k. Cars assembled in North America can qualify for up to 7500 in federal EV tax credits 3750 if the battery components were built in North America and 3750 if critical minerals in.

A new 4000 or 30 of purchase price whichever is less credit was added for used vehicles. New Bill Could Get Hyundais EV Tax Credits Back Oct. That price threshold rises to 80000 for new battery electric SUVs vans or pickup trucks.

Those buying a pure EV stood to qualify in full from the credit whereas a purchaser of a plug-in hybrid. The Inflation Reduction Act which President Biden signed Aug. New tax credit of up to 4000 for used EVs put into service after Dec.

Audi of America Kia Corp 000270KS and. A new bill introduced in the US Congress called the Affordable Electric Vehicles for America Act would allow essentially all EVs in the US to qualify for the 7500 tax credit if passed. As part of a broad new legislative packagethe Inflation Reduction Actthat addresses climate change healthcare and taxes there is a new tax credit of up to 4000 on used electric cars.

The bill extends the tax credit for new qualified plug-in electric drive motor vehicles through 2031. The maximum amount of the extended EV tax credit is 7500 credit for new vehicles. The credit amount will vary based on the capacity of the.

The new tax credits replace the old incentive system which only. 05 2022 421 PM ET by Jared Rosenholtz Government 12 Comments And not just Hyundai all foreign automakers. Oct 04 2022 at 1109am ET.

Beginning January 1 however those credits will be capped at 150000 income for a single filing taxpayer and 300000 for joint filers.

Bill Would Triple Number Of Evs Eligible For Federal Tax Credit

:max_bytes(150000):strip_icc()/electric-car-tax-credit-e769c0c589c549d0a6db66b42821bc0e.jpg)

Decoding The New Electric Vehicle Tax Credits How To Tell If Your Car Qualifies

Even Elon Musk Wouldn T Support Missouri S Ev Tax Credit Bill Show Me Institute

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

A Made In America Ev Tax Credit What Car Buyers Need To Know If Biden Can Advance A Sliced And Diced Build Back Better Bill Marketwatch

Fixing The Federal Ev Tax Credit Flaws Redesigning The Vehicle Credit Formula Evadoption

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Pkf Mueller

New Clean Vehicle Tax Credit Plan Means Most Evs No Longer Qualify Forbes Wheels

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek

Tesla Gm Buyers Would Get Ev Tax Credits Again Under Democrats Climate Bill Cnn Business

Oil Industry Front Group Launches Latest Attack On Electric Vehicle Tax Credit In Senate Energy Bill Desmog

Proposed Legislation Would Remove Ev Tax Credit Limit Adapt Automotive

The U S Government Plans To Slice 7 500 Off Electric Car Prices But It S Complicated The Autopian

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek

Senate Tax Reform Bill Would Extend Ev Tax Credit 2017 12 12 Agri Pulse Agri Pulse Communications Inc

End Of Federal Ev Tax Credit Would Not Be The Death Of Evs Cleantechnica

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

.jpg)