nj employer payroll tax calculator

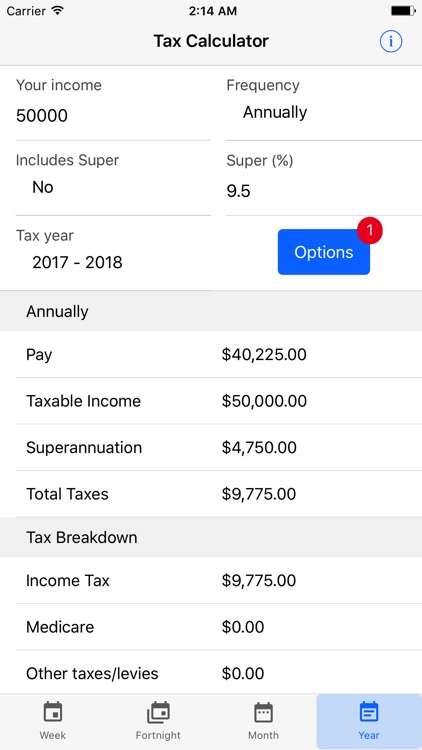

You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202122. New Jersey property taxes.

Payroll Calculator Free Employee Payroll Template For Excel

Our paycheck calculator for employers makes the payroll process a breeze.

. The withholding tax rates for 2022 reflect graduated rates from 15 to 118. Get Started With ADP. Ad Explore ADP For Payroll Benefits Time Talent HR More.

Calculate accurate take home pay using current Federal and State withholding rates. New Jersey Salary Paycheck Calculator. Get 3 Months Free Payroll.

Rates range from 05 to 58 on the first 39800 for 2022. Fast Easy Affordable Small Business Payroll By ADP. Employer Payroll Tax Calculator 2022.

As a result of COVID-19 causing people to work from home as a matter of public health safety and welfare the Division will. The standard FUTA tax rate is 6 so your. NJ Income Tax - Withholding Information.

This New Jersey bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. Fast Easy Affordable Small Business Payroll By ADP. Get 3 Months Free Payroll.

Well do the math for youall you need to do is. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Jersey. New Jersey Tax Information.

It is not a substitute for the. Mortgage rates in New Jersey. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022.

New Jersey Hourly Paycheck Calculator. Important note on the salary paycheck calculator. New Jersey Gross Income Tax.

Use the New Jersey paycheck calculators to see the taxes on your paycheck. The maximum unemployment tax. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Share Your Feedback. The 118 tax rate applies to individuals with taxable. New Jersey Hourly Paycheck Calculator.

Lead Source --None-- Email Call in Support Referral Intercom Chat Referral Request A Live Demo Contact Us Sale Products Start your 30-day Free Trial Free-trial 1st Step. The employee withholding rate will decrease to 0675. 11 to 28 for 2021.

Free paycheck calculator for both hourly and salary employees. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Jersey residents only. 11 to 28 for 2021.

Federal income taxes are also withheld from each of your paychecks. New Jersey retirement taxes. New Jersey Unemployment Tax.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The wage base increases to 34400 for 2019. Our calculator has recently been updated to include both the latest Federal.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Your employer uses the information that you provided on your W-4 form to. The IRS has changed the withholding rules.

Ad Explore ADP For Payroll Benefits Time Talent HR More. More About This Page. How Your New Jersey Paycheck Works.

Then you are probably looking for a fast and accurate solution to calculate your employees pay. New Jersey new employer rate. New Jersey new employer.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. New Jersey paycheck calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

How To Calculate Your Overtime Tax Gocardless

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Paycheck Calculator Take Home Pay Calculator

Salary Calculation Sheet Template As The Name Indicates Is A Spreadsheet That Helps Calculate Each Employ Payroll Template Spreadsheet Design Excel Shortcuts

Nanny Tax Payroll Calculator Gtm Payroll Services

Income Tax Calculator Estimate Your Refund In Seconds For Free

What Are Marriage Penalties And Bonuses Tax Policy Center

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Withholding Calculator Online 55 Off Www Ingeniovirtual Com

Paycheck Calculator Template Download Printable Pdf Templateroller

Aussie Taxes Ato Income Tax Calculator By Meerkat Technologies

How To Calculate Taxable Income H R Block

Paycheck Calculator Take Home Pay Calculator

Self Employed Tax Calculator Business Tax Self Employment Employment

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Dutch Income Tax Calculator I Expat Service